Optical Character Recognition (OCR) has been around for some time, with the development of the first OCR device credited to Gustav Tauschek in the early 1900s. Following Tauschek’s invention, Edmund Fournier d’Albe created an OCR device intending to help visually impaired people read. These devices turned words on paper into telegraph codes and tones that corresponded to numeric and alphanumeric characters. Since then, OCR technology has evolved significantly and has seen widespread applications in many industries.

In the healthcare industry, for example, OCR has been used to extract data from clinical trial reports, medical charts, prescription scripts, and other paper documents. But there is a segment of the revenue cycle that could benefit greatly from the use of OCR – extraction of data from paper claims and Explanation of Benefits (EOB). Before we can truly understand the benefits of OCR in the revenue cycle, let’s take a quick look at the claim submission, adjudication, and payment processes.

Medical Claim Submission, Adjudication, and Payment Process

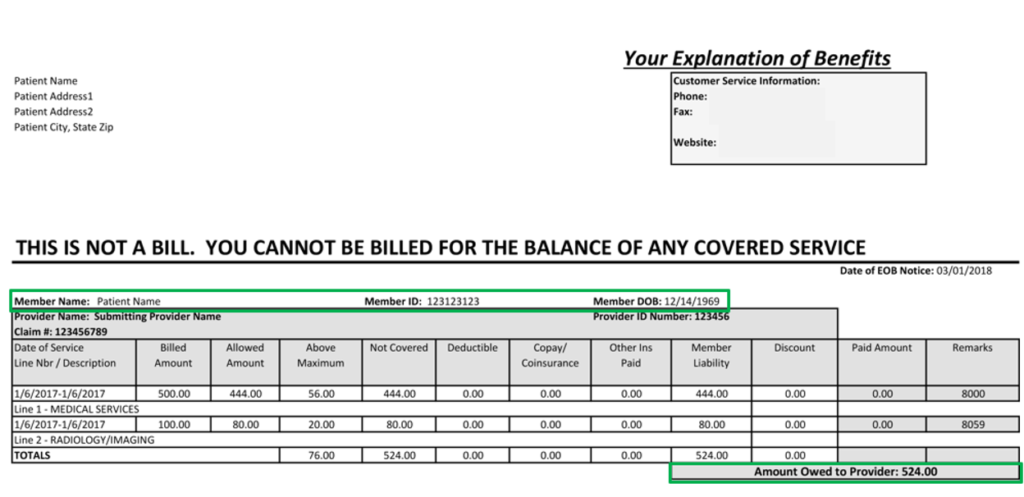

After a patient visits a physician, the physician’s notes are used by medical coders and billers to create a medical insurance claim. The claim, whether in paper or digital form (EDI-837), is sent to the payer. The payer adjudicates the claim and provides payment and remittance advice in a digital form (EDI-835) or paper form (Check and EOB). The payment is deposited into the provider’s bank account and the remittance advice is used for posting the payment in the patient’s account.

OCR in Revenue Cycle

While it may seem like an easy decision to incorporate OCR into any revenue cycle process, it has not been readily adopted due to the various challenges of using OCR. The use of paper documents such as medical records, medical claims, EOB’s, etc. is still prevalent within the revenue cycle.

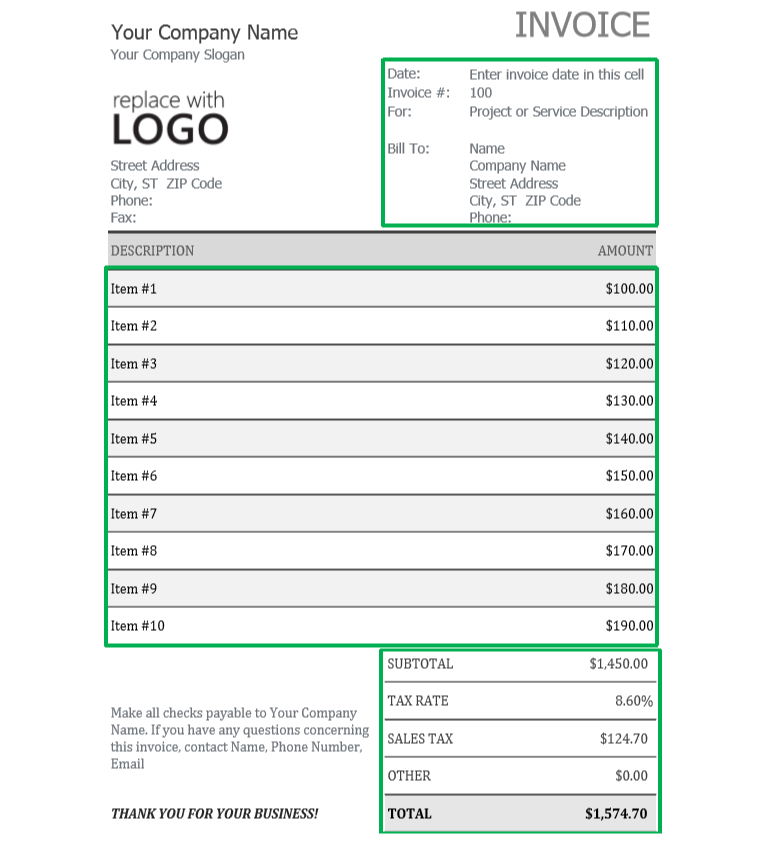

A critical challenge in the world of using OCR within the revenue cycle is the concept of ‘OCR in the Wild’: when the specific data can be anywhere within the image. For example, when an employee scans receipts to include in an expense report, the entire receipt is scanned although the only information needed for the expense report is the date, the specific items with their associated costs, and the total cost. This is known as the “region of interest”. The other information, such as cashier name, cashier number, store phone number, etc. is unnecessary and makes it more difficult to extract the relevant data.

Similarly, documents within the healthcare industry may contain a variety of unnecessary information. For example, Explanation of Benefits (EOB) forms may have extensive information, but the regions of interest are the patient’s information such as their name, date of birth, and patient ID number as well as the claim ID number and the total amount owed to the provider. This information can be in the upper left corner of the document, while another Payer’s EOB format might have the same information in the lower right corner. OCR can locate, read, and copy the information, but it takes additional tools for the solution to identify the contents of that document image.

OCR capabilities have increased over the years but still yield satisfactory results only for limited use cases. Deep learning paves the way to the development of robust OCR solutions by properly identifying regions of interest within the forms. Data extraction through OCR then becomes easier by focusing only on these regions while ignoring the rest. Very few vendors, however, offer OCR solutions enhanced by Artificial Intelligence (AI)-based technology.

A critical consideration in a viable solution to bridge the divide between digital and manual processes is to ensure not only the reliability of solutions but also that the solutions integrate seamlessly into their current workflow with minimal disruption.

Healthtek offers revenue cycle management solutions that use deep learning techniques to combat the prevalent challenges OCR poses in the healthcare industry. These solutions integrate into existing workflows encouraging a continuous payment posting process. More about these solutions can be found here, or by reaching out to [email protected].